charitable gift annuity administration

Benefits of a Charitable Gift Annuity. That is a portion may.

Cga Program Best Practices You Need To Know A Review Of The Acga Cgp Cga Survey

The surveys include questions related to.

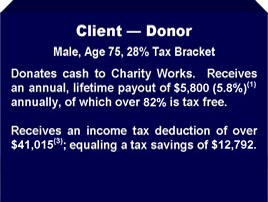

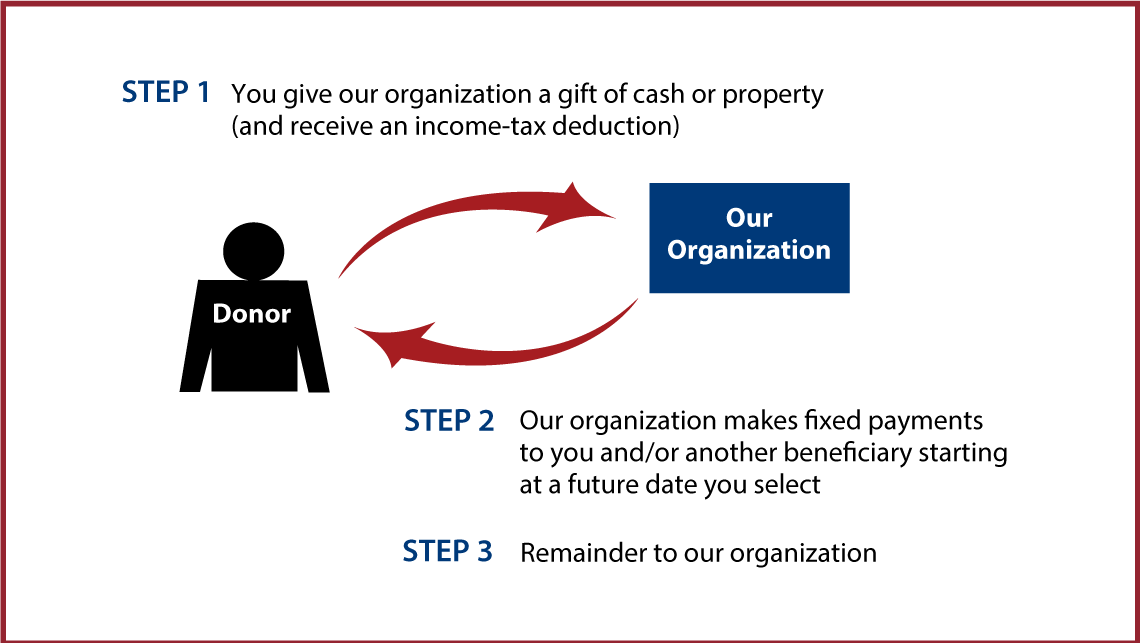

. A charitable deduction in the year you make the gift. The American Council on Gift Annuities approved new gift annuity rates that became effective July 1 2003. Support the area of Duke most meaningful to you.

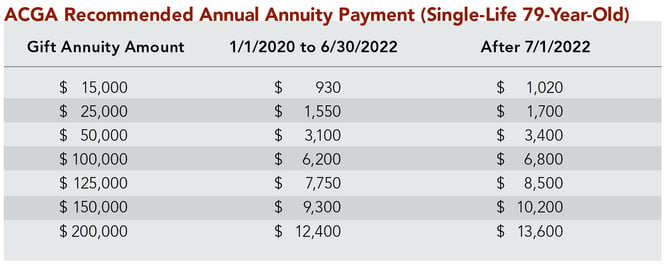

As of July 1 2022 Duke can offer even better annuity rates than before. Establish a gift with as little as 10000. Established in 1995 Charitable Trust Administration Company.

Toapply for a special permit to issue charitable gift annuities. Charitable gift annuity reinsurance is simply a financing technique whereby a charity chooses to purchase a commercial single premium immediate annuity either an individual or group. A Charitable Gift Annuity is a contract between a donor and National Catholic Community Foundation that provides a lifetime of annuity payments to the donor and survivor or other.

Why would a donor want to create a testamentary charitable gift annuity CGA. Previously she was with Charitable Trust Administration Company where she. Alexandra Sedor serves as Director of Gift Annuity Administration for the National Gift Annuity Foundation.

Your gift to Duke establishes. We focus on non-cash asset receipt and disposition charitable gift annuity risk management gift annuity. 133 rows Rates Announcement - 6222.

And once you lock in your higher rate it is yours for life no matter how the markets change in the future. Send a cover letter there is no formal application form along with the materials requested. Offering constructive expert administration services to assist you and your donors in managing your philanthropic endeavors.

The gift annuity surveys conducted by the ACGA are the best source of information about charitable gift annuity policies practices and trends. We offer comprehensive affordable gift annuity administration for your charitable organization freeing you to concentrate on other tasks. Enjoy charitable deductions and other tax-saving opportunities.

There is an additional fee of 50 for charitable gift annuities and its proceeds fund an annuity reserve fund that guarantees. A charitable gift annuity allows you to eliminate capital gains tax when you donate long-term appreciated assets including non-income-producing property. A portion of the annual income amount tax free for life expectancy of the annuitants Fixed.

Charitable Solutions LLC is a planned giving risk management consulting firm. The base WatersEdge administration fee is 105. The Board of Directors of the ACGA met on May 17 2022 and voted to increase the rate of return assumption we use when suggesting.

Please see the chart that follows for the current rates. Gift Annuity Rates Table. We tailor our services to.

In the past the reasons to create a testamentary CGA were simple provide for someone like a.

Charitable Capital Gift Annuity Program

Estate Planning Charitable Gift Annuity How It Works

Pet Therapy Charitable Gift Annuity Lifelong Pet Care

Gift Annuity Administration Services Crescendo Interactive

Ways To Give One Valley Community Foundation

Charitable Gift Annuity Pros And Cons Blog Jenkins Fenstermaker Pllc

Charitable Gift Annuity Licensing Compliance In Maryland Harbor Compliance

Charitable Gift Annuities Uses Selling Regulations

Charitable Gift Annuity National Gift Annuity Foundation

Charitable Gift Annuities University Of Montana Foundation University Of Montana

Gift Annuity Administration Software Crescendo Admin Crescendo Interactive

International Violin Competition Of Indianapolis Planned Giving Deferred Payment Gift Annuity

Gift Annuity Administration Software Crescendo Admin Crescendo Interactive

Planned Giving Archives University Of Maine Foundation

Gift Annuity Payout Rates Are Increasing

Does Your Non Profit Offer Charitable Gift Annuities 3 Things To Do Now Veritus Group

Endowment And Foundation Challenges Managing Charitable Gift Annuities Brown Advisory

The Gift That Pays You Income Diocese Of Sioux City Sioux City Ia